Sleep Review’s Q3 2013 Sleep Center Survey shows sleep centers are reducing bed capacity as home testing continues to increase.

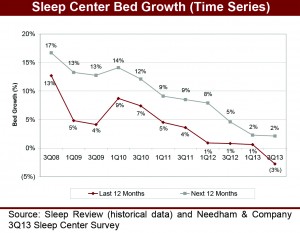

Since the inception of Sleep Review’s Sleep Center survey in 2008, sleep centers have reported that they have experienced bed growth. Now, for the first time, sleep centers have indicated that they are contracting. Despite the finding, actual volume growth may be understated given the increased use of home sleep testing.

Sleep Centers Are Contracting

According to Sleep Review’s Q3 2013 Sleep Center Survey, sleep centers have started to contract. Average beds per respondent decreased by 2.8% over the last 12 months to 6.8 beds from 7 beds. And average beds per respondent are expected to increase by 2.1% over the next 12 months to 7 beds from 6.8 beds. We note that 9.5% of respondents indicated that they have fewer beds now than 12 months ago.

We offer a few caveats about the results:

1. Sleep center growth is more correlated with new patient diagnoses and flow generator sales while most mask sales are replacements;

2. Sleep center growth as defined in our survey represents the growth of existing centers rather than the creation of new sleep centers;

3. Bed growth obviously does not capture the impact of home sleep testing; and

4. In some cases, respondents are indicating the total number of beds for multiple sleep centers, which could push up the average number of beds per respondent (ie, the average number of beds per respondent does not necessarily represent the average number of beds per individual sleep center).

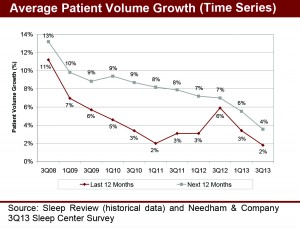

Patient Growth Continued to Slow

Patient volume growth is slowing. Average patient volume growth was 1.8% over the last 12 months, and average patient volume growth is expected to be 3.6% over the next 12 months. The historical and expected patient volume growth rates are different from the historical and expected bed growth rates (which were -2.8% and 2.1%, respectively). We suspect that this difference is due to increased use of home sleep testing by the sleep centers.

Increased Use of Home Testing Is Hurting Bed Growth

The Office of Inspector General (OIG) rejected the American Academy of Sleep Medicine’s recommendation for the development of a new safe harbor for sleep medicine in November 2012, and respondents expect this to reduce bed growth by an average of 2%. And Medicare reimbursement for out of center sleep testing codes (95800 and 95801) increased by 9% to 12% in 2013. Given this, 43% of respondents indicated that they expect to increase involvement with home sleep testing, 25% do not expect any changes, and 7% expect to reduce their bed count.

Medicare reimbursement for the in-center polysomnography codes (95808, 95810, and 95811) decreased by 3% to 4% in 2013 and respondents expect this to reduce bed growth by an average of 2.5%. Commercial insurers are increasingly emphasizing home sleep testing, and respondents expect this to reduce bed growth by an average of 5.6%.

Sleep Centers’ Use of Home Sleep Testing Is Growing

Currently, 72% of sleep centers offer home sleep testing for patients with commercial insurance and 55% offer home testing for patients with Medicare. In two other questions about home sleep testing, 62% of respondents indicated that they expect to increase involvement in home testing and 50% of respondents have reduced their expansion plans as a result of home testing.

Auto-Setting Flow Generator Utilization Is Increasing

On average, respondents report that 14% of their patients use auto-setting flow generators and 11.4% of their patients use bi-level flow generators. Over the longer term, use of auto-setting flow generators has steadily climbed while use of bi-level flow generators has been relatively stable.

Increased use of auto-setting flow generators is probably the result of increased use of home sleep testing since auto-setting flow generators do not require the patients to be titrated to determine the proper pressure setting.

Only a Minority of Sleep Centers Sell CPAP Equipment

Just 14% of sleep centers report selling CPAP equipment and 4% to 5% expect to start selling it in the next 12 months. Over time, the portion of sleep centers selling CPAP equipment has been gradually declining.

Slightly More Medicare Patients May Receive Oral Appliances

Medicare has started to cover oral appliances for sleep apnea patients. Respondents expect this to increase the number of patients receiving oral appliances by an average of 2.1%, with little impact on the number of their patients receiving CPAPs.

About the Survey

The survey was e-mailed to around 12,000 sleep professionals. Of these, 501 responded to the survey, resulting in a response rate of about 4%. We note that response rates varied for each question since respondents were not forced to answer every question. Of the respondents, 391 (78%) completed the entire survey. The responses were collected between June 17 and June 27. Sleep center directors/supervisors/managers (36% of respondents) and registered polysomnographic technicians (26% of respondents) were the most common types of respondents. Every geographic region and 48 US states were represented, with the Midwest (31% of respondents) and Southeast (29% of respondents) most heavily represented.