Sleep Review and Needham & Co’s 3rd quarter 2014 survey results show improvements in key areas.

Sleep Disorders Evaluated 3rd Quarter 2014 (3Q14)

Sleep disorders evaluated are consistent with our 1Q14 survey. The vast majority of sleep center patients are being evaluated primarily for obstructive sleep apnea (OSA) and other sleep-breathing disorders, which came in at 78.1% in this survey. Second is insomnia (8%), and third is restless legs syndrome and other limb movement disorders (6%). Narcolepsy and other sleep disorders each accounted for about 4% of the patients evaluated at these sleep centers.

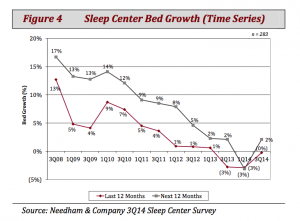

Bed Growth Improved from Prior Survey

Over the last 12 months (LTM), average beds per respondent were nearly flat at 9.0 beds. But over the next 12 months (NTM), average beds per respondent are expected to increase slightly by 2.1% from 9.0 beds to 9.2 beds. We note that 9% of respondents indicated that they have fewer beds now than they did 12 months ago. Both the LTM and NTM growth rates improved from -2.9% and -3.1%, respectively, in our 1Q14 survey.

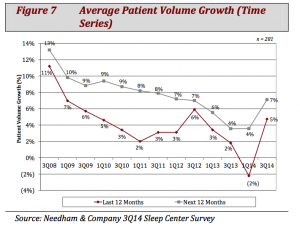

Patient Growth Also Improved from Prior Survey

Over the LTM, respondents report patient volume growth of 4.7%. But over the NTM, respondents expect patient volume growth of 7.1%. Both the LTM and NTM growth rates improved from -2.2% and 3.6%, respectively, in our 1Q14 survey.

The historical and expected patient volume growth rates are different from the historical and expected bed growth rates (which were -0.2% and 2.1%, respectively). We suspect that this difference is due to increased use of home sleep testing (HST) by the sleep centers.

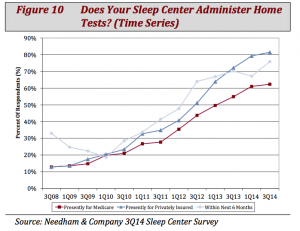

Home Sleep Tests Still Minority of Sleep Center Tests

The results of the survey show that on average 15% of OSA tests are done with home sleep tests rather than in-lab tests. This is the same as our prior survey. Over time, we expect this to grow, although we did not ask respondents about their future expectations.

Currently, 82% of sleep centers offer home sleep testing for patients with commercial insurance compared to 62% that offer home testing for patients with Medicare. In two other questions about home sleep testing, 60% of respondents indicated that they expect to increase involvement in home testing, while 34% of respondents have reduced their expansion plans as a result of home testing.

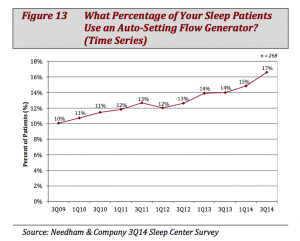

APAP Use Continues to Increase

On average, respondents report that 16.6% of their patients use auto-setting flow generators, also known as APAP. This compares to 14.8% in our 1Q14 survey. In addition, 13.4% of their patients use bi-level flow generators (compared to 13.0% in our 1Q14 survey). Over the longer term, use of auto-setting flow generators has steadily climbed, while use of bi-level flow generators has been relatively stable. Increased use of APAP is probably the result of increased use of home sleep testing.

Oral Appliances as First-line Therapy

For the second time, we asked sleep professionals about patients who start OSA treatment with oral appliances (without first trying a PAP device). The average came out to 4.9% of patients trying oral appliances as their first-line therapy, up from an average of 4.2% in our 1Q14 survey). More specifically, 41.3% responded that none of their patients start with an oral appliance; 50.2% responded that between 1% and 9% of their patients start with an oral appliance; 5.6% responded that between 10% and 19% of their patients start with an oral appliance. Only small percentages (1% or less) indicated that 10% or more of their patients started with an oral appliance.

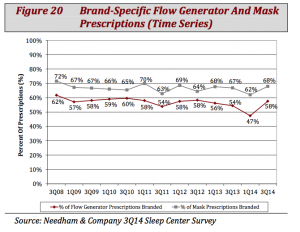

More HMEs Asking for Changes to Branded Prescriptions

Around 20% of respondents indicated they have been asked to make changes to branded prescriptions by HMEs due to competitive bidding. This is an increase from 13% in our prior survey. On average, sleep centers reported writing brand-specific prescriptions for 68% of mask prescriptions and for 58% of flow generator prescriptions. The rate of branded prescriptions had been relatively stable in recent years, and this survey seems to show that the brand-specific results in our prior survey may have been an anomaly.

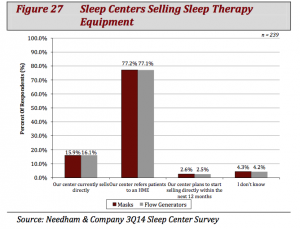

Minority of Sleep Centers Sell CPAP Equipment

Just 16% of sleep centers report selling CPAP equipment, while only 3% expect to start selling in the next 12 months. Over time, the portion of sleep centers selling CPAP equipment has been gradually declining, yet we’ve seen this trend rebound somewhat in the last 6 months.

About the Survey

Needham & Company LLC and Sleep Review conducted a survey of US sleep centers. The survey received 299 responses, which were received between May 28 and June 26, 2014. Registered polysomnographic technologists (37% of respondents) and sleep center directors/supervisors/managers (31% of respondents) were the most common types of respondents. Every geographic region, and 47 US states, was represented, with the Midwest (28% of respondents) and Southeast (28% of respondents) most heavily represented.

Mike Matson, CFA, is a senior research analyst, medical technologies & diagnostics, at Needham & Company LLC. Comments and questions may be sent to [email protected].